Before you buy a property, whether it is in your country or in any foreign country, you must know all the details about the taxes related to this property, and be fully aware of the laws, amounts, and expenses that must be paid.

Taxes imposed on real estate in Turkey upon purchase include both Turkish citizens and foreigners to the same extent.

Taxes in Turkey are relatively low compared to other countries, so that the Turkish government seeks to attract foreign investors and Turks while providing them with facilities in many fields, and taxes on real estate in Turkey when purchased in total range between 5% to 6% of the value of the property While in other countries it reaches 10% or 20% of the value of the property.

In this article, we will review the taxes imposed when buying a property in Istanbul and Turkey:

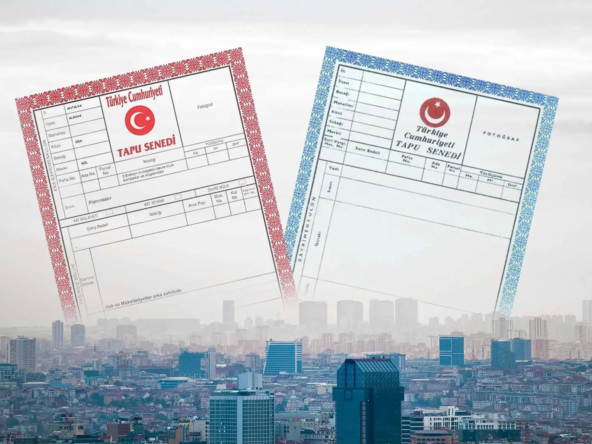

Title deed transfer tax (Tapu)

This tax is paid once when the title deed is transferred from the seller’s name to the buyer’s name, which usually amounts to 4% of the property price registered in the sales contract. This tax is often shared equally between the seller and the buyer, so that the seller pays 2% and the buyer pays 2%.

Property ownership tax in Turkey

It is also equivalent to 3.9% of the property price, paid once.

In addition to the previous taxes, additional fees are added, including: translating the buyer’s passport into the Turkish language and then attesting it at the Turkish Notary Public, estimated at approximately 50 US dollars, and the fee for obtaining a title deed in the name of the new property owner, amounting to approximately 60 dollars.

Annual property tax

The Turkish government imposes the payment of an annual tax for real estate owners to the municipality affiliated with it, and it is called EMALK VERGESI, and its value is estimated at approximately 0.003 of the value of the property, and this tax is in return for the services provided by the municipality to the population.

Compulsory insurance for earthquakes and natural disasters

Earthquake and natural disaster insurance for homes is compulsory in Turkey, unlike general insurance, and it is calculated according to the area of the house, and each square meter is estimated at 2 US dollars.

Most Turkish banks provide insurance service for earthquakes and natural disasters called DASK

Monthly taxes within residential complexes

Residents of residential complexes in Istanbul or Turkey generally have to pay a monthly amount called the returns, which are fees for the services provided by the residential complex, such as swimming pools, sports clubs, maintenance, playgrounds, and gardens. This amount varies according to the area of the apartment, so that the returns are calculated on the basis of the total area For an apartment, it is estimated on average between 2-4 Turkish liras per square meter, and the difference in these fees is due to the quality of the services provided and the level of services.

Electricity and water fees on the property in Turkey

It is an amount that is paid as a deposit when the electricity and water meters are opened for the first time (and it is returned when these meters are closed, in the event that the apartment or property is sold in the future, for example)

The insurance value varies according to whether the property is new or if the property had a previous owner

- In the event that the property is new, the insurance value is $150 for electricity and $200 for water, which is considered a registration fee.

- In the event that the property had a previous owner, the insurance value is 100 dollars for electricity and 120 dollars for water, and it is considered a transfer fee.

These fees are paid in the Directorates of Electricity and Water, so that within each region there is a Directorate of Water and a Directorate of Electricity.

As for the monthly bills, they are calculated according to consumption and the monthly exchange amount. These bills can be paid through designated centers or points, or through a bank account.